Buy life insurance online without medical exam is becoming increasingly popular. This method offers convenience and potentially faster processing, but it’s crucial to understand the implications and limitations before applying. The process typically involves completing an application online, answering health-related questions, and providing necessary documentation. Ultimately, the decision to pursue this route hinges on individual needs and risk tolerance.

Understanding the underwriting process is key to navigating the complexities of securing coverage without a medical exam. Different insurance companies may have varying criteria for evaluating risk and approving applications. This can impact the premiums and coverage options available to you. Thorough research and careful consideration are essential to finding a suitable policy.

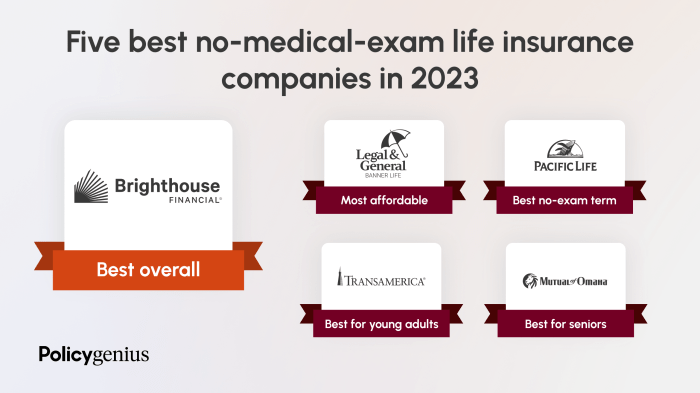

Life insurance is a crucial financial tool, providing protection for your loved ones in the event of your passing. While traditional methods often require a medical exam, the rise of online insurance options has made it easier than ever to secure coverage without one. This guide dives deep into the world of online life insurance, exploring the benefits, drawbacks, and crucial considerations for prospective buyers.

Source: enrollfirst.com

Understanding the “No Medical Exam” Option

Many online life insurance providers offer policies that waive the medical exam requirement. This is often a key selling point, streamlining the application process and potentially making coverage more accessible. However, it’s crucial to understand the implications of this exemption. This often translates to higher premiums or a narrower range of coverage options compared to policies requiring a medical exam.

What Factors Influence the Absence of a Medical Exam?

Insurance companies employ sophisticated risk assessment models to determine eligibility and premium rates. Without a medical exam, they rely heavily on your provided answers in the application, your age, and potentially your lifestyle choices to assess risk. These assessments can often include details about your health history, habits (like smoking or alcohol consumption), and even occupation. Policies that don’t require medical exams are typically for individuals with a lower perceived risk profile, though there are some exceptions.

Benefits of Online Life Insurance Without a Medical Exam

The convenience of online applications is undeniable. You can complete the application process from the comfort of your home, often in a matter of hours. This convenience can be a major advantage, especially for those who are busy or have limited mobility.

Faster Application Process

The absence of a medical exam significantly reduces the application timeframe. You can often receive a decision much quicker than with traditional methods.

Accessibility for Specific Needs

For individuals with pre-existing conditions, online insurance can provide a pathway to coverage, even if they might be ineligible for traditional policies.

Drawbacks of Online Life Insurance Without a Medical Exam

While convenient, policies without medical exams come with trade-offs.

Higher Premiums

Insurance companies factor in the risk associated with not having a medical exam. This often results in higher premiums compared to policies with medical exams, which allow for a more accurate assessment of risk.

Source: ctfassets.net

Limited Coverage Options

Policies without medical exams often have more stringent coverage limits and exclusions. The insurance company may limit the amount of coverage or the types of illnesses or accidents covered. This is a significant consideration for long-term planning and peace of mind.

Potential for Declined Applications, Buy life insurance online without medical exam

Although the application process is quicker, it’s not immune to rejection. If your answers in the application suggest a higher risk profile than anticipated, your application might be declined. This is a crucial aspect to understand.

Key Considerations Before Applying

Carefully weighing the pros and cons is essential. Consider your specific needs, budget, and health status before making a decision. A comprehensive evaluation of your situation is crucial.

Assess Your Financial Needs

Determine the amount of coverage you need to protect your loved ones’ financial well-being.

Compare Different Policies

Don’t settle for the first policy you find. Compare policies from multiple providers to ensure you get the best value for your money. Online comparison tools can be a valuable resource.

Understand Policy Exclusions and Limitations

Thoroughly review the policy documents, paying close attention to exclusions and limitations. This will help you avoid surprises down the line.

Frequently Asked Questions (FAQ)

- Q: Can I get life insurance without a medical exam if I have a pre-existing condition?

A: Some online providers might offer coverage, but it often comes with higher premiums or limitations. Carefully review policy details.

- Q: How do I compare different online life insurance policies?

A: Utilize online comparison tools to compare policies from various providers, considering premiums, coverage amounts, and other key features.

- Q: Are policies without medical exams less reliable?

A: The reliability depends on the insurer and your individual circumstances. Be sure to carefully review the terms and conditions of the policy.

- Q: What are the potential risks of buying life insurance online without a medical exam?

A: Higher premiums and limited coverage options are common. Thorough research and careful consideration are essential.

Conclusion and Call to Action: Buy Life Insurance Online Without Medical Exam

Purchasing life insurance online without a medical exam can be a convenient option for many. However, it’s crucial to weigh the benefits against the potential drawbacks. Carefully compare policies, understand the exclusions, and thoroughly evaluate your needs before making a commitment. Consider consulting with a financial advisor for personalized guidance.

Don’t delay securing your financial future. Apply for life insurance today and take the first step towards peace of mind.

In conclusion, buying life insurance online without a medical exam presents a streamlined approach to coverage, but careful evaluation of policy terms and potential limitations is crucial. Understanding the trade-offs between convenience and comprehensive assessment of risk is vital for making an informed decision. Ultimately, the right choice depends on individual circumstances and financial goals.

Question Bank

What are the common exclusions in policies that don’t require a medical exam?

Policies without medical exams often have exclusions for pre-existing conditions or specific health risks. Review the policy details carefully to understand any limitations.

Source: quotesbae.com

How do premiums for these policies typically compare to those with medical exams?

Premiums for policies without medical exams are generally higher due to the increased risk assessment for the insurer. It’s essential to compare quotes from multiple providers.

What documentation is usually required for online applications?

Typical documentation includes personal information, employment details, and potentially, a copy of your driver’s license. Specific requirements may vary between providers.

Can I still get coverage if I have a pre-existing condition?

Coverage for pre-existing conditions might be limited or excluded entirely. Review policy details carefully and consider consulting with a financial advisor.